It is no secret that London experienced a particularly brutal pandemic. Since March 2020, businesses across the capital have lost the equivalent of about six months of the revenue they would normally expect from visits by UK customers following successive lockdowns. The growth of working from home continues to weigh on the metropolis. But there is a mystery: where did all the money go?

For the past six months, the FT has been looking at the recovery from the pandemic using a particular data set: a local spending database supplied by the Social Investment Business, a regeneration charity. The data shows the value of card transactions by a sample of UK consumers, logged by where a purchase happened.

This data shows revenues from in-person visits by those customers to any business with a card-reader in London have not yet recovered to pre-pandemic levels. Overall, they were down by 2 per cent in May compared to the same month in 2019, the last pre-pandemic summer.

This, of course, disguises major local variation: the monthly in-person spending in Zone 1 — the transport area that covers the most central part of the city — was still off 9.7 per cent.

Spending at outlets in the City of London, the central financial district most reliant on trade from commuters, was down by 31 — thirty-one! — per cent.

Neighbouring Westminster is doing better, being down by just 5 per cent. But only because businesses in the area are able to adapt to changing tastes.

Geoff Barraclough, cabinet member for planning and economic development for the council, said: “Sunday is much busier and Friday early evenings much less. This reflects growing demand for shopping trips but much less interest in five-day-a-week office work.”

So far, so expected. The surprise, however, is that there is not an obvious offsetting rise in the suburbs.

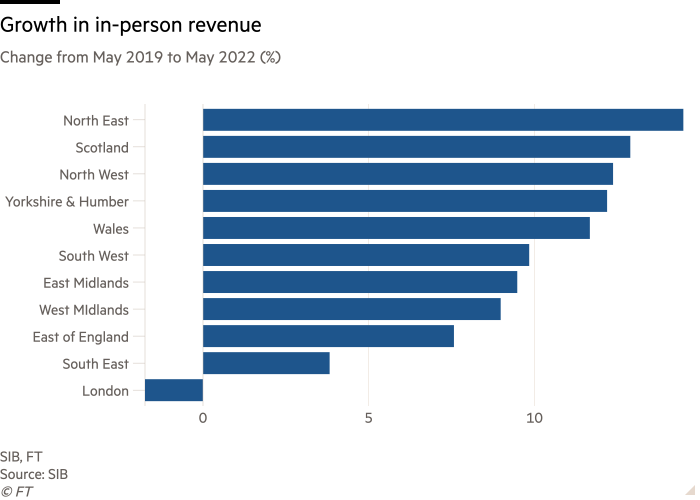

You hear people tell you their neighbourhoods are buzzing. But take Zones 5 and 6, which form the outer rim of the city. Spending is up, but only by around 3 per cent. And the south east of England — the region containing all the counties around London — is up by just 3.8 per cent. The spending missing from the middle has not simply been spread out into where workers live.

This mystery has another component: other areas of the country are rebounding much faster. The north east — the quickest-growing region for sales — is up by more than 14 per cent compared to 2019. Scotland is up by more than 12 per cent. Why is in-person spending in London and the south east rebounding so much more slowly than the rest of the country?

This is a bit of a puzzle. Whatever the gap is between the south east and the rest, it opened up early in the pandemic, and has remained fairly constant. Part of the answer may be that frugal Londoners are just saving a bit more: those Pret sandwiches from before are being turned into pennies in the bank.

But the rest of the answer may be that people are buying more online, and so spending less in-person. There is some other evidence supporting this conclusion. Paul Swinney, director of policy and research at the Centre for Cities, said: “We found that during the pandemic, more affluent places, particularly in the south east, tended to spend more money online. And that spending may have proved to be quite sticky.”

Some of this online spend may still be supporting local high streets: if they are buying delivery food via an app for example, a good wedge of that cash ends up with local outlets. Online grocery shopping, in particular, may have replaced a multitude of trips to newsagents, coffee shops and restaurants with a visit from a local supermarket worker.

But the switch online may mean spending is going elsewhere. So this all hints at a double whammy for businesses serving the south east. Some parts of the region are suffering deeply from the loss of the commuter flow. But it may be that even in those places where people are now confined to their neighbourhoods, they are proving peculiarly unreliable when it comes to switching their spending to local businesses.

[email protected]

@xtophercook

https://www.ft.com/content/9d629147-f2aa-41e8-9a8a-eccf8b9c0186