As globalisation and diplomacy checklist underneath renascent nationalism, Britain strikes out by itself. An ascendant China performs exhausting ball, forcing America to do the identical. Global temperatures creep up whereas economies slowly shift towards a brand new power system. Executives of multinationals attempt to stability these advanced and infrequently conflicting pursuits, as traders aspire to ever-increased company requirements.

For anybody eager to grasp the colliding worlds of US-China relations, the UK’s position outdoors the European Union, the worth-versus-development debate and the final use of environmental, social and governance (ESG) components, one London-listed inventory supplies an unparalleled information. HSBC (HSBA) is many issues: storied, vastly highly effective and but oddly susceptible. Trading at simply over half its document market worth, it’s also an unpopular firm amongst fairness traders, regardless of possessing what’s arguably a far stronger future earnings profile than a lot of its banking friends.

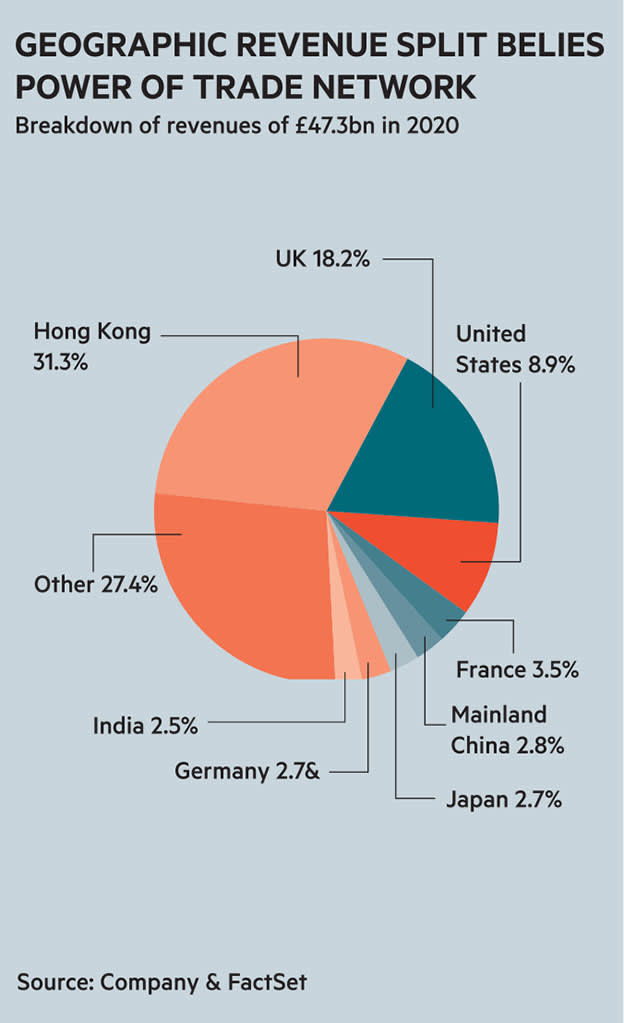

A stroll by means of the jetway of an inbound worldwide flight to London Heathrow offers you a very good really feel for its enterprise pitch. Every three toes, a poster reminds you of a sprawling international banking community, main place as a commerce financier and dedication to myriad geographies. In the phrases of 1 investor, the bank’s “distinctive promoting level is its worldwide community, which it makes good cash from”.

Neither a Wall Street grasp of the universe nor merely a home lender, it payments itself as a accomplice bank to development-oriented companies making an attempt to navigate new markets. Founded as a monetary bridge between Europe and Asia greater than 150 years in the past, it’s nothing if not skilled on this area.

It can be, to adapt Theresa May’s phrase, a company citizen of nowhere. Since its incorporation in the UK in 1993, HSBC is nominally accountable to a democratic authorities and British governance requirements. But most of its income come from Hong Kong and China, and it transacts in a forex and sector by which US lawmakers finally maintain sway.

Yet regardless of this big activity and the bank’s bureaucratic fame, the technique has labored for lengthy-time period purchase-and maintain traders. Over 35 years – a interval that features monetary deregulation, the GFC and Covid-19 – the inventory has delivered a 60-fold whole return, in comparison with a 1,627 per cent return from the FTSE All-Share.

It appears unwise to wager in opposition to an establishment so politically linked and systemically essential. But doubts about its lengthy-time period future are rising. How lengthy can the balancing act final?

An extended political historical past

The histories of most giant banks are deeply intertwined with politics and governments. HSBC isn’t any exception. Established in a colonial outpost in the wake of Britain’s devastating wars on China in the nineteenth century, the Hongkong and Shanghai Banking Corporation’s first industrial success was to finance the British Empire’s commerce in opium from India to China.

Forced out of Hong Kong by the Japanese invasion in the second world warfare, the bank’s ambitions in higher China have been once more checked after its return to the metropolis state in 1946 with the arrival of communism. The second half of the twentieth century noticed concerted worldwide enlargement, together with into the Middle East, India and the US, whereas the bank turned more and more nervy about the looming switch of Hong Kong rule from Britain to China.

In 1987, seven years after its effort to purchase RBS was rebuffed by the Bank of England and one 12 months after unveiling the Norman Foster-designed headquarters in Hong Kong, HSBC began to accumulate shares in the UK’s Midland Bank. A takeover was accomplished in 1992.

This, in HSBC’s personal phrases offered it with a European foothold “to rework itself into a really worldwide bank”. Unsurprisingly, fears surrounding Chinese nationalisation or the deep sense of shock senior executives felt after the Tiananmen Square bloodbath go with out point out in the official historical past.

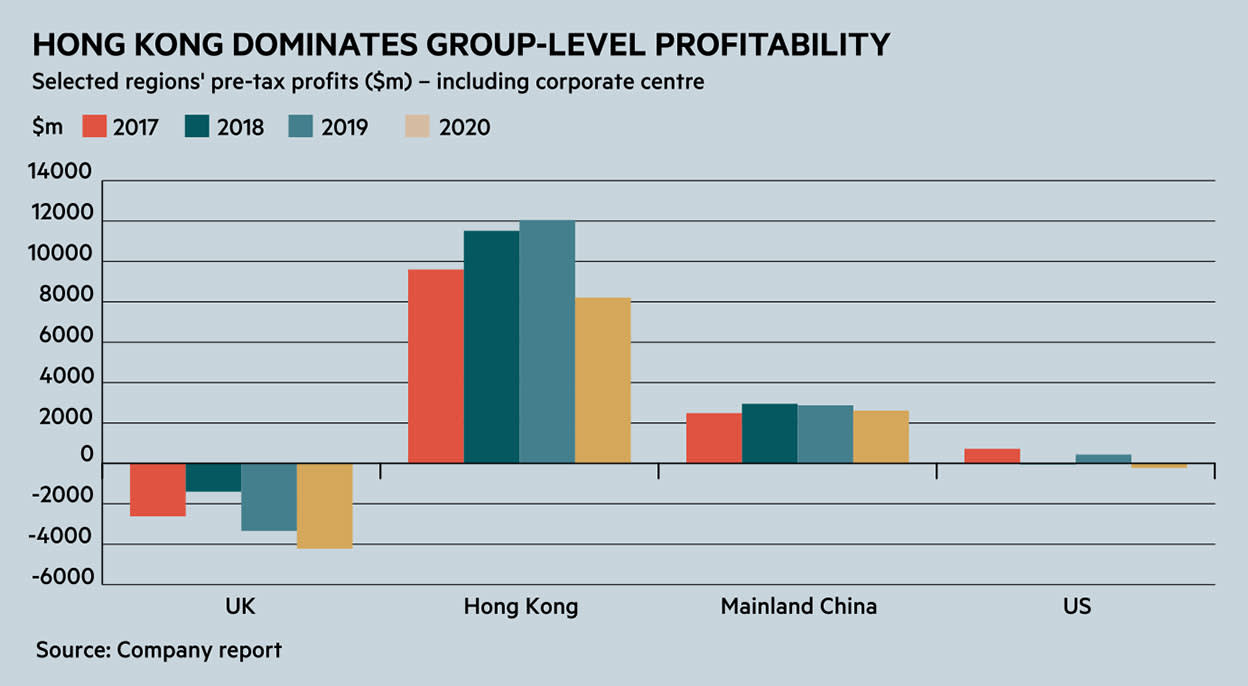

Three many years on, throughout which era the share of HSBC’s group-huge income from Hong Kong have grown with China’s epic financial growth, this sophisticated and politically charged backdrop continues to divide market opinion (see dealer views chart).

Sometimes, this division is all too evident. On the launch of its half-12 months leads to November, the UK fairness-targeted Edinburgh Investment Trust (EDIN) cited “an unsure enterprise setting in Hong Kong in addition to the metropolis’s disproportionate publicity to broader geopolitical pressures”, as a cause for promoting out of the shares.

A month later, the belief was again in. “The new administration is making demonstrable progress in streamlining the bank and has an intent to refocus the enterprise which we imagine will turn out to be extra evident in the strategic income at present being undertaken,” stated Edinburgh portfolio supervisor James de Uphaugh in a month-to-month replace to belief holders. HSBC needs to be “a major beneficiary of the restoration in international commerce and commerce” added de Uphaugh, who declined to remark for this text.

Reasonable returns

Exposure to an Asian-led publish-pandemic financial rebound is the newest rephrasing of a well-known bull level to the shares: not like its UK friends Lloyds Banking (LLOY) and NatWest (NWG), HSBC has a robust footprint in real structural development markets in Asia, together with wealth administration and a dominant and extremely worthwhile franchise in Hong Kong (see chart).

Under chief govt Noel Quinn, the bank’s newest plans are to reallocate underperforming capital to increased-yielding jurisdictions. By subsequent 12 months, round half of all threat-weighted property will sit in Asia, up from 42 per cent in 2019. Together with chunky new investments in the continent and additional rounds of price-reducing, the bank hopes this may result in a return on tangible fairness of between 9 and 10 per cent inside three to 4 years. “I believe that is fairly achievable with – critically – what I believe is sort of a gritty administration staff,” says one lengthy-time period investor in the group.

The technique just isn’t with out headwinds, nonetheless. Although China’s pushback in opposition to Alibaba and TenCent recommend the assumed risk posed by Asian fintechs to conventional banking could also be overdone, some analysts imagine the granting of digital banking licences to expertise firms might quickly begin to chew away at revenues in Hong Kong. And whereas an exit from US retail banking – the place the lender has by no means recovered from its disastrous 2003 acquisition of sub-prime mortgage lender Household – seems like a smart transfer, a permanent presence in UK banking is without delay much less interesting.

Among its UK-regulated rivals, HSBC is one in every of the greatest capitalised, deposit-wealthy and most cheaply-financed. “It desires to place the deposits to work as a lot as it may possibly in mortgages, which is an effective return enterprise,” notes one shareholder, whereas admitting that distribution efforts with mortgage intermediaries have typically lacked ample velocity and engagement.

Key market disaster

Another interpretation of HSBC’s dedication to the UK is that its London headquarters function a structural insurance coverage coverage for the a number of crises engulfing its main earnings-producing hub.

This got here to a head final June, when Asia Pacific CEO Peter Wong signed a petition backing China’s proposed nationwide safety legal guidelines for Hong Kong. HSBC didn’t search to justify the transfer past an announcement in assist of “legal guidelines and laws that can allow HK to get well and rebuild the economic system and, at the identical time, keep the precept of ‘one nation, two programs’”. Critics say the legal guidelines assist China take away the proper to protest and freedom of speech, thereby dashing constitutional ideas enshrined in the PRC’s administration.

Those critics embrace the US. After then-Secretary of State Mike Pompeo described HSBC’s backing as a “present of fealty” and “company kowtow” to China, Washington positioned monetary sanctions on a listing of people accused of undermining Hong Kong’s autonomy, amongst them the metropolis’s chief govt – and rumoured HSBC buyer – Carrie Lam.

Soon after, studies emerged that the bank had itself frozen the bank accounts of professional-democracy campaigners on the orders of Hong Kong police. In January, Quinn was hauled earlier than the UK’s Foreign Affairs Committee to elucidate the transfer.

“As a CEO I can not cherry decide what legislation to observe or not,” he instructed MPs. “We try to remain out of the politics of 1 nation versus one other. There isn’t any profit in HSBC strolling away from the neighborhood of Hong Kong – I see little profit in that. I’d solely hurt Hong Kong; I’d not assist it.”

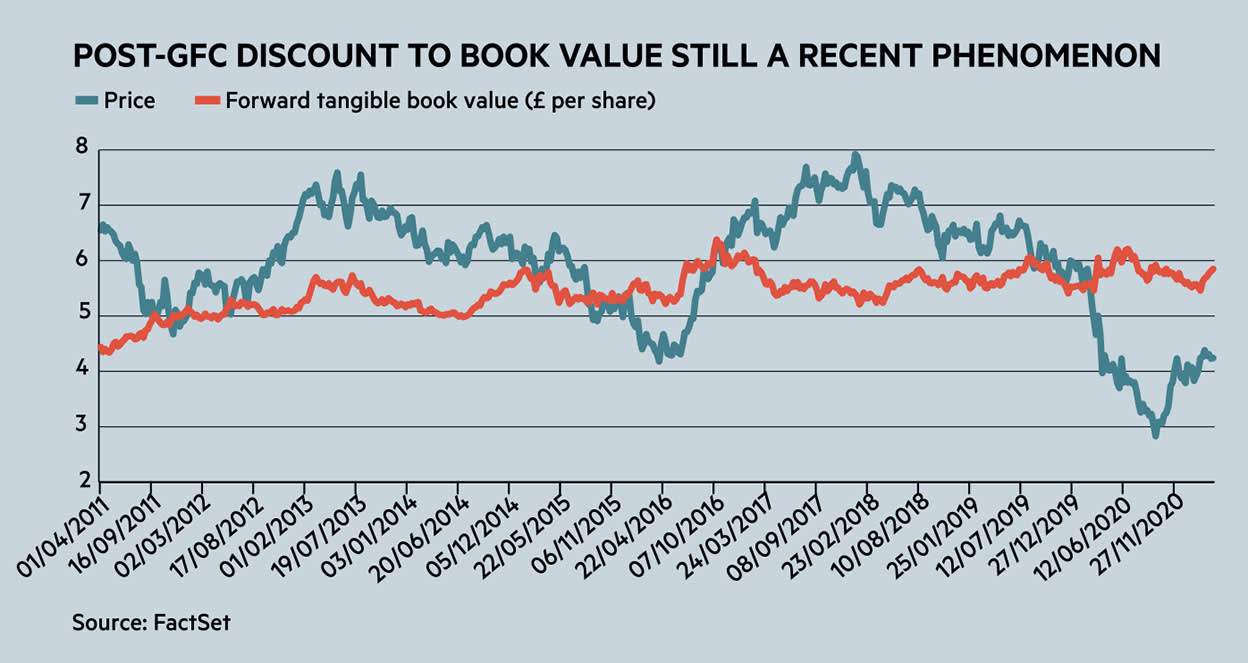

At the identical time, HSBC has been caught in a standoff between the US and China on Chinese expertise group Huawei, accused by both facet of performing as a shill for the different. With an at-instances remoted UK authorities chastising the bank for its obvious assist for the erosion of democracy, any sense of political safety seems to have evaporated together with market sentiment and the shares’ historic premium to e book worth (see chart).

Eye of the storm

Although occasions have just lately deteriorated, Hong Kong’s final financial and political future has all the time been in flux, even after a 50-12 months pause button was pressed in 1997. Despite its measurement, HSBC has lengthy believed that gradual change will give it time to adapt, smoothing out any quick-time period spikes in the shares’ threat premia.

“This is simply my hypothesis, however I believe the senior administration calculation may be that the scenario with Hong Kong will blow over, finally folks will overlook the nationwide safety legislation, a brand new regular will take maintain, and the enterprise gained’t be significantly degraded by the episode,” says Derek Leatherdale, who runs GRI Strategies, a geopolitical threat consultancy.

On one other studying, Hong Kong is only one manifestation of a extra intractable problem for HSBC. “It actually is the exemplar of how firms, wherever they’re headquartered, can get caught up in deteriorating US-China relations,” says Leatherdale, who used to work in the bank’s authorities affairs division and arrange its inner geopolitical threat staff. “When I have a look at the trajectory of these relations, I believe the dilemma for HSBC, and more and more for different firms, will stay at the very least as acute as it’s now. Investors can be proper to problem whether or not corporates adequately anticipate the enterprise impacts of this, or have the capabilities to take action.”

On one flank is a simmering commerce warfare. On one other are escalating army tensions in the Pacific. Then there may be China’s remedy of Uighur Muslims in Xinjiang, which the US has labelled as genocide. Sensing the writing on the wall, some western producers are extricating their provide chains from the nation. US tech teams Facebook, Twitter, Google and LinkedIn have stated they may defy knowledge requests underneath China’s new safety legislation.

Investor responses to all of this have various. One marketing consultant who advises pension funds on ESG issues queried whether or not a divestment-led method is a type of legitimate engagement. “If an organization’s in Hong Kong or China, traders needs to be asking how it’s responding to the political scenario. Is it lively? Is it doing good? Is it not?”

For some, that has meant a more durable public stance. Last 12 months, prime-10 institutional shareholder Aviva Investors stated it was “uneasy” at the choice of each HSBC and Standard Chartered (STAN) to publicly again the Hong Kong nationwide safety legislation. “We anticipate each firms to substantiate that they may additionally converse out publicly if there are any future abuses of democratic freedoms linked to this legislation,” stated Aviva Investors chief funding officer David Cummings.

Others usually tend to view assist for the safety legislation in zero-sum phrases. “With ESG turning into more and more essential, we imagine that administration’s stance will likely be exhausting to swallow for a lot of traders,” wrote RBC analyst Benjamin Toms in a latest notice – which is about as candid as a bank is ever prone to be on the topic.

In their language, some traders – together with Aviva or Hermes EOS – nonetheless suggest that engagement is feasible, and {that a} screening-primarily based overview of the bank’s social impression just isn’t the solely instrument at hand.

One such optimist is investor activist group ShareMotion, which cited HSBC’s latest choice to section out the financing of coal-fired energy as the product of a close to 5-12 months engagement with the bank. “Shareholders can’t change the world on their very own, however they could be a very efficient a part of wider efforts to advertise change,” a spokesperson instructed Investors’ Chronicle.

On the query of democratic freedoms in Hong Kong, ShareMotion sees room for shareholder appeals. It argues that HSBC has an obligation to respect residents’ human rights, “no matter whether or not these are protected by their very own state”, and that the bank ought to perform rigorous due diligence to grasp if it has induced or contributed to human rights breaches.

De-merger query

At a sure level, nonetheless, engagement might turn out to be a futile train. Already, a number of monetary commentators have argued {that a} spin-out of the UK bank, or a separation from China, could also be inevitable if US monetary sanctions ratchet up.

On this level, there may be prone to be loads of brinksmanship, too. HSBC is designated by the Bank of International Settlements as a worldwide systemically essential bank, which means huge monetary collateral injury would doubtless circulate from any choice by US lawmakers to intrude with its banking licence or means to transact in {dollars}.

Although the bank’s publicity to China can’t be simply diversified, issues must darken considerably for a break up to be required.

Then once more, City sources recommend the complexities of a break up might be overcome. “I believe it’s rather more doable than it was [pre-GFC],” says one investor. “There was a giant regulatory transfer to verify every geographic subsidiary can get up by itself if it has an issue.”

There are additionally a number of sector precedents, albeit on a smaller scale. Clydesdale Bank, now subsumed into Virgin Money (VMUK), was spun out of National Australia Bank in 2016, three years after TSB was pressured to separate from Lloyds. Pan-African monetary companies companies Investec (INVP) and Old Mutual (OMU) have since de-merged their wealth administration arms Ninety One (N91) and Quilter (QLT), whereas with one eye on increased-development markets in Asia, life insurer Prudential (PRU) minimize itself from UK asset supervisor M&G (MNG) in a deal that required a fancy division of solvency capital.

One main City banking lawyer stated a separation of HSBC would doubtless require approvals from shareholders along with itemizing authorities and banking regulators. Management would additionally must think about what would doubtless show to be staggering prices, together with the charges {of professional} advisers and – absent some form of merger – the price of constructing separate IT programs.

Then there are the strategic issues. With its roots in worldwide commerce finance, a lot of the worth of HSBC’s enterprise is tied up in serving clients throughout greater than 60 nations and territories. It is much less clear what the commerce finance staff can be tethered to in the occasion of a de-merger, except the objective is to easily hive off UK retail banking. Even then, it’s exhausting to ascertain what impression – if any – this may have on China.

Asked by the Foreign Affairs committee chair Tom Tugendhat if HSBC might have to separate its Chinese operations from the remainder of the world, Quinn was defiant. “I totally acknowledge that being a global bank is difficult, and is getting more and more difficult, however I imagine…that the economic system of the world requires worldwide banking to be a part of the scene.”

It’s a good abstract of the place his enterprise is at in 2021. Until the challenges turn out to be insurmountable, a de-merger would wrestle to create a lot worth for shareholders, clients or the enterprise itself. As such, the three events usually tend to stay locked in a excessive-wire embrace as the greatest energy sport performs out.

| Consensus analyst estimates | 2021e | 2022e |

| Cost to earnings | 65.5% | 61.0% |

| Return on tangible fairness (RoTE) | 5.2% | 7.5% |

| Non-performing loans ($m) | 19,477.0 | 19,866.0 |

| Risk weighted property ($m) | 883,294.0 | 917,047.0 |

| Tier 1 capital ratio | 18.2% | 18.2% |

| Net curiosity margin (%) | 1.177 | 1.186 |

| Total income ($m) | 50,735.7 | 52,528.7 |

| Net curiosity earnings ($m) | 26,743.8 | 27,791.1 |

| EPS ($) | 0.45 | 0.58 |

| P/E (x) | 12.8 | 10.0 |

| Source: FactSet |